A Solid Investment Opportunity.

ZINC Income Fund generates predictable cash flow with passive real estate investment opportunities. We specialize in short-term fix and flip loans with the first lien position to provide a secure, consistent return for our investors.

Learn About ZINC Income Fund in 60-seconds

I love the outdoors and enjoy my passion for real estate Investments. What I don’t love is having my investments on a roller coaster ride, involving unnecessary risk. The investment world is full of pitfalls and risks; it doesn’t have to be that way.

I founded ZINC Income Fund because I saw the need for an investment opportunity that is safe and reliable with a consistent passive income. I often refer to our fund as our ‘fixed income annuity fund, as our returns are stable and provide monthly cash flow with exceptional security.

On average, our returns meet or exceed 7-10% while offering the principal protection of a priority first position lien on all of our holdings.

We both understand that results are not guaranteed. However, our 18-year track record speaks for itself with a loss ratio of less than 1/8%. I invite you to look through our website and learn more about how you can invest your money right alongside my own.

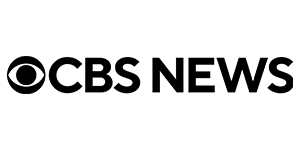

We Know You Have Many Options

When It Comes To Your Investing.

ZINC’s private money loans have historically outperformed cash investments and demonstrated lower risk than stocks.

Investments in loans funded by ZINC are secured by a first position lien on physical real estate.

They offer an element of principal protection not afforded by other investments.

ZINC Real Estate Private Loans

Versus Other Asset Classes

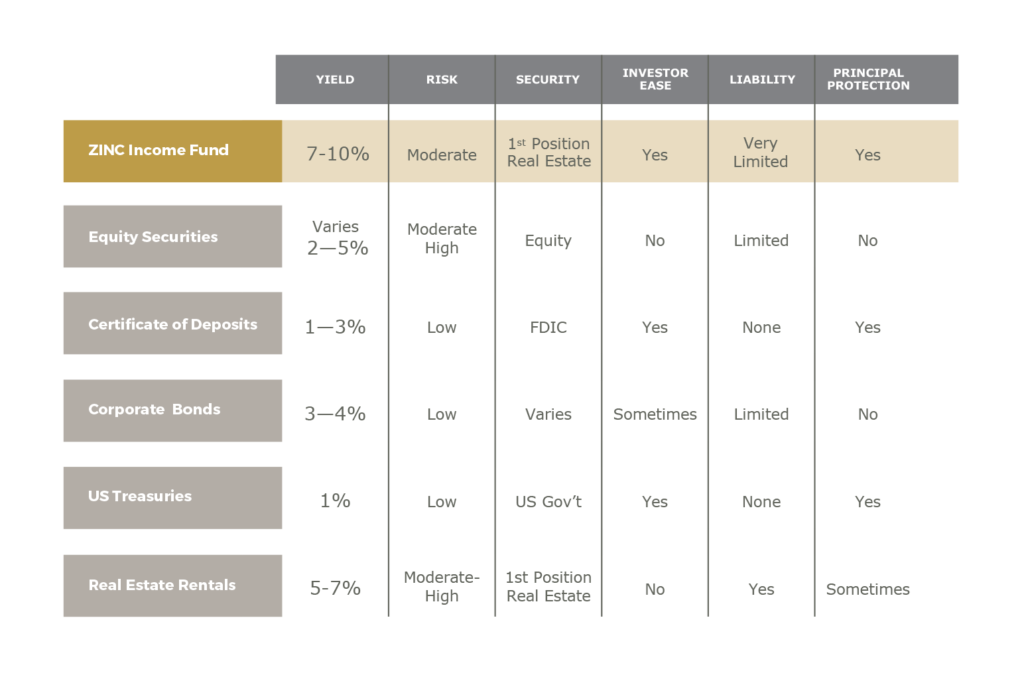

Historical Rate of Return For

ZINC’s Trust Deed Investments

Note: For illustrative purposes only. Past performance is not a guarantee of future results. Please see the Fund’s confidential private placement memorandum for all the terms and conditions of the offering.

As Seen On